Help your business grow

Welcome to our e-commerce page, we offer a range of online payment solutions to help you grow your business and supercharge your payments. We understand that every business is unique, which is why we offer a range of payment options to suit your needs. Whether you need a virtual terminal, online payments, or API options, we have you covered.

- Online payments provide customers with a convenient and secure way to make purchases from anywhere, at any time.

- Virtual terminals enable payment acceptance over the phone or through email, facilitating remote transactions.

- eCommerce platforms offer a seamless online shopping experience with secure payment processing and customizable checkout options.

- Online payment solutions are suitable for small businesses or large enterprises.

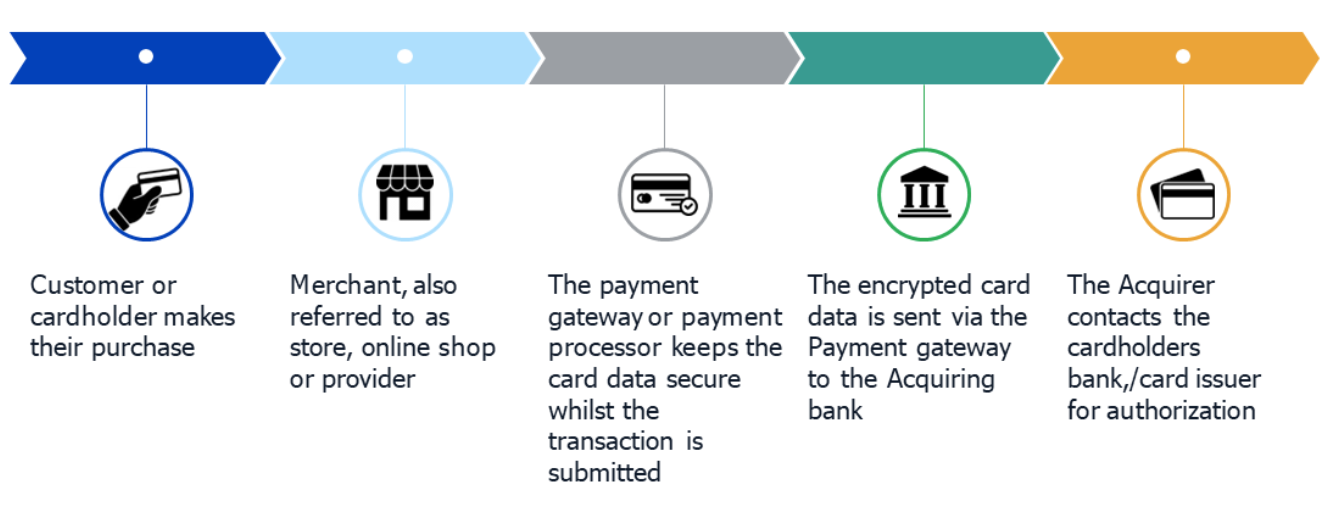

How does it work?

Virtual Terminal

- Our virtual terminal is an easy-to-use payment solution that allows you to process payments over the phone or by mail order.

- With our virtual terminal, you can securely accept payments from customers anywhere in the world, without the need for any additional hardware.

- Our virtual terminal is perfect for businesses that need to take payments quickly and securely, especially those that operate remotely or don’t have a physical storefront.

- Our virtual terminal is PCI DSS compliant, ensuring that your business and customer data is protected at all times.

- Our virtual terminal supports all major credit and debit cards, as well as alternative payment methods such as PayPal and Apple Pay.

- Our virtual terminal is customizable, allowing you to set up recurring payments, process refunds, and generate reports to help you manage your business more efficiently.

Pay by QR Code/Link

- Cardstream’s pay by QR code/link product is a payment solution that allows customers to pay for products or services by scanning a QR code or clicking on a payment link.

- This payment method is becoming increasingly popular in ecommerce because it provides a quick, easy, and contactless way to pay.

- Cardstream’s pay by QR code/link product is especially useful for businesses that don’t have a physical storefront, as it allows customers to make payments remotely.

- Cardstream’s pay by QR code/link product can be used for a variety of payment types, including one-time payments, recurring payments, and donations.

- Cardstream’s pay by QR code/link product can be integrated into eCommerce websites, allowing customers to pay for products or services directly from the website.

- Cardstream’s pay by QR code/link product is a secure payment method, as it uses encryption to protect customer data and prevent fraud. Cardstream is PCI DSS Level 1 certified, ensuring that all transactions are processed in compliance with the highest security standards.

Payment Gateway

- Cardstream’s payment gateway platform is a secure and reliable payment processing solution that enables merchants to accept payments from customers worldwide.

- The platform supports a wide range of payment methods, including credit and debit cards, PayPal, Apple Pay, and more.

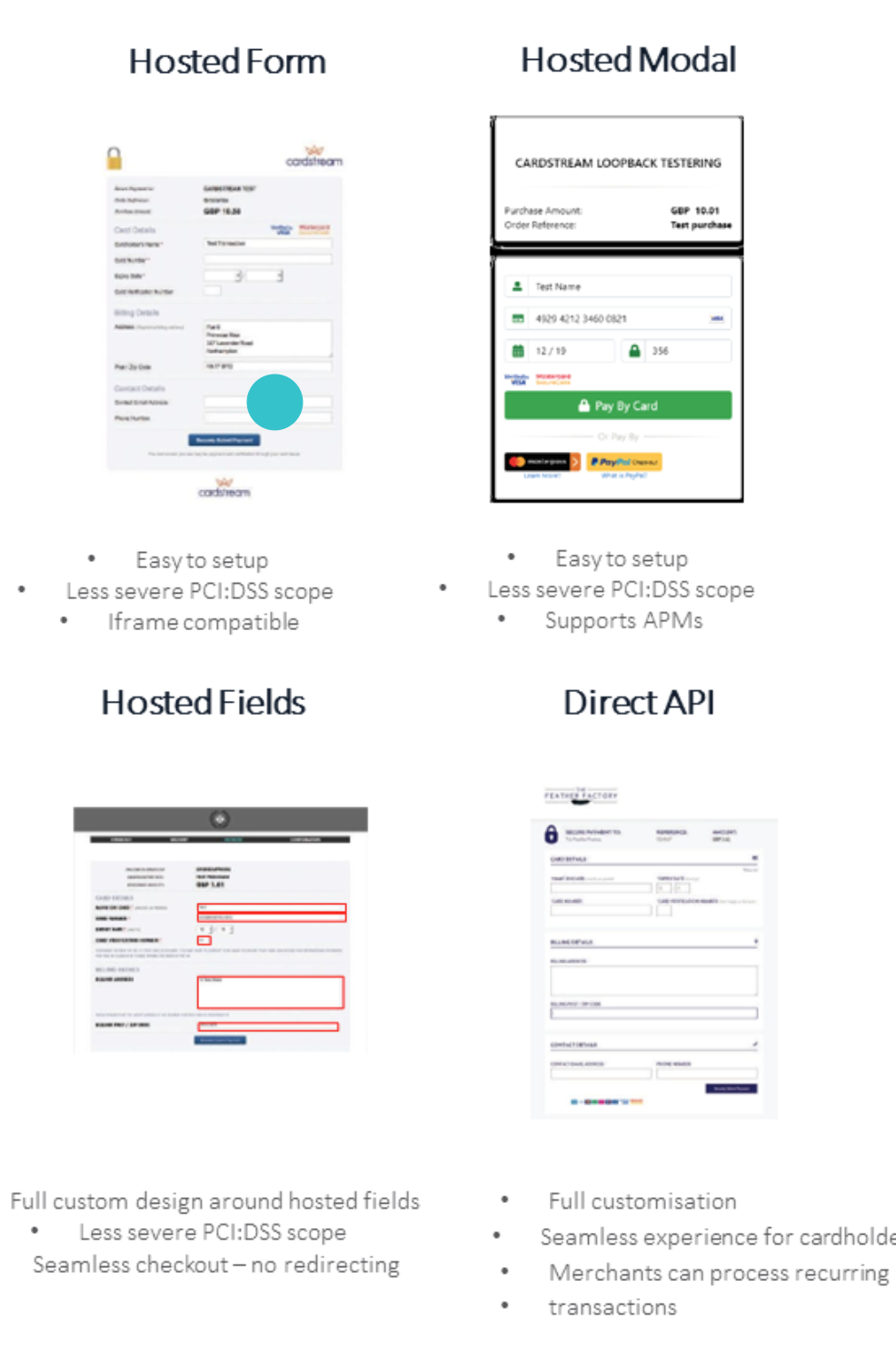

- Cardstream’s payment gateway platform offers multiple integration options to suit different business needs, including:

- Hosted form: Merchants can use Cardstream’s hosted payment form, which is customizable and can be branded to match the merchant’s website.

- Hosted modal: Merchants can use Cardstream’s hosted payment modal, which pops up over the merchant’s website and provides a seamless payment experience.

- Hosted fields: Merchants can use Cardstream’s hosted payment fields, which are embedded directly into the merchant’s website and offer a secure payment experience.

- Direct API: Merchants can use Cardstream’s direct API to integrate the payment gateway platform directly into their website, enabling a fully customized payment experience.

- Cardstream’s payment gateway platform is PCI DSS Level 1 certified, ensuring that all transactions are processed in compliance with the highest security standards.

Why choose motto?

See what our customers are saying

Financial disclaimer:

To be eligible for the one-month rolling terminal hire contract provided by motto merchant services ltd, customers must have switched from their current acquirer to EVO Payments UK, arranged through motto merchant services ltd. To be eligible for the 18-month terminal hire contract provided by motto merchant services ltd, you must be a new to acquiring customer using EVO Payments UK as your card acquirer, arranged through motto merchant services ltd. The Next Day Banking Settlement service provided by EVO Payments UK incurs an additional fee of £4 a month on top of your acquiring service charges and fees. Provided your card machine performs a reconciliation before 12am (midnight), you’ll receive settlement of funds the next banking day. NBC acts as an independent sales organisation for terminal hire agreements, provided by motto merchant services on behalf of EVO Payments UK. EVO Payments UK is the trading name of EVO Payments International GmbH, licenced by the Federal Financial Supervisory Authority BaFin (Bundesanstalt fur Finanzdienstleistungsaufsicht) in Germany and regulated by the FCA (FRN number 653606) for conduct of business rules.

Editorial disclaimer:

The information we provide does not constitute financial advice and might not apply to your business. Always carry out research into your business’ needs when choosing a new merchant services provider. Sometimes, we link to other third-party websites to provide you with additional information. At the time of publication, we consider the information accurate, however, we do not have control over their content and are not responsible if any information on these websites change. The products we display on our website are for illustrative purposes only – if your business requires additional facilities, you may receive a different model than advertised. All of the information contained on this website, including fees, services and functionality, are correct at time of publishing.